Tips for First Time Home Buyers

Are you in the market for your very first home? If so, congratulations! Buying a home is an exciting milestone. It’s a crucial moment in your life where you get to lay down some roots and start building equity.

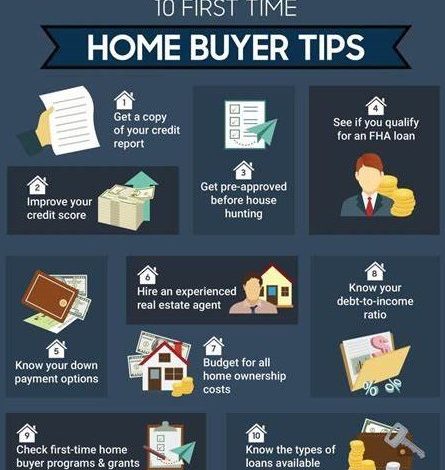

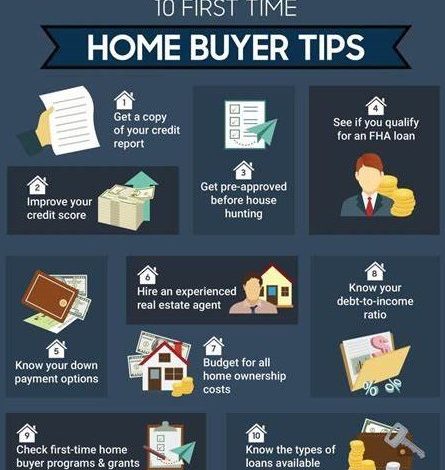

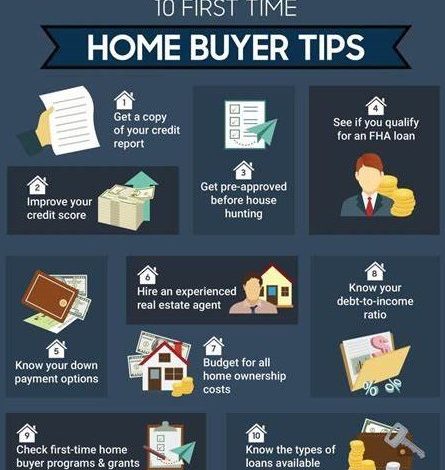

That being said, buying a home is also a big responsibility. It’s not something that should be taken lightly. To help you make the best decision for your first home purchase, we’ve compiled a list of tips for first time home buyers:

Do your research

If you’re thinking about buying a home, the first thing you need to do is do some research. There’s a lot to learn, from understanding the different types of mortgages to figuring out how much home you can actually afford. Fortunately, there are plenty of resources available to help you get started. The internet is a great place to start your research, and you can also talk to family and friends who have already been through the process. Once you understand the basics, you’ll be ready to start looking for your dream home.

Get your finances in order.

One of the most important things to do when you’re buying a home for the first time is to get your finances in order. This means getting a clear picture of your income, debts, and assets. You’ll also need to look at your credit score and history. If you have any outstanding debt, now is the time to pay it off. This will help you qualify for a better mortgage rate. It’s also a good idea to start saving for a down payment. Aim for 20% of the purchase price. This will help you avoid paying private mortgage insurance (PMI). Once your finances are in order, you can start shopping for the perfect home!

Get pre-approved for a mortgage.

Home buying can be a complicated and overwhelming process, especially if you’re a first-time buyer. But one of the most important things you can do to set yourself up for success is to get pre-approved for a mortgage loan. This will give you a much better idea of how much house you can afford, and it will also put you in a stronger position when it comes time to make an offer on a property.

To get pre-approved, contact a lender and calculate your mortgage loan. Then, submit your application along with any supporting documentation. Once your application is approved, you’ll receive a pre-approval letter that you can use when shopping for homes. So if you’re thinking about buying a house, be sure to get pre-approved for a mortgage loan first. It could make all the difference in the world.

Know what you can afford

There are a few different factors to consider when determining your budget, including the cost of the home itself, closing costs, and ongoing expenses like property taxes and insurance. You’ll also need to factor in the price of any necessary repairs or renovations. Once you have a clear idea of your budget, you’ll be better positioned to start shopping for your new home. Remember that it’s also important to leave yourself some financial wiggle room. Unnecessary expenses can always pop up, so it’s best to err on caution when creating your budget.

Have a down payment saved up

Before you start shopping for your first home, it’s crucial to have a down payment. The down payment is the amount of money you’ll need to pay upfront to purchase the house, and it typically ranges from 3-20% of the total purchase price. If you don’t have the entire down payment saved up, there are a few options available to you. You may be able to qualify for a government-backed loan that requires a smaller down payment, or you could get help from family or friends. No matter how you plan to finance your down payment, it’s essential to start saving early so that you can make your dream of homeownership a reality.

Work with a real estate agent.

Working with a real estate agent can make the process much easier. A good agent will be familiar with the local market and can help you find properties that match your budget and needs. They can also offer advice on financing options and help you negotiate with sellers. Plus, they can handle all of the paperwork and other details about buying a home. So if you’re looking to buy your first home, be sure to work with a real estate agent.

Final thoughts

These are just a few things you can do to set yourself up for success as a first-time homebuyer. Working with a real estate agent and doing your homework can make the process smoother and less stressful. Are there any other tips that you would add?

Meta title: Home-Buying Tips for New House Shoppers

meta desc: You may be wondering what you need to do in order to buy your first home. In this blog post, we will provide you with tips for first time home buyers.