Everything You Need to Know about Estate Tax

In this article, we’ll discuss everything you need to know about the estate tax. This includes what estate tax is, how it works, and how to minimize your liability, among others.

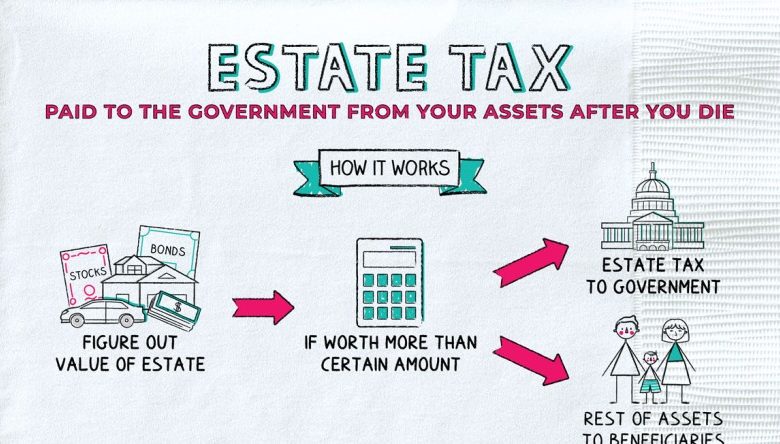

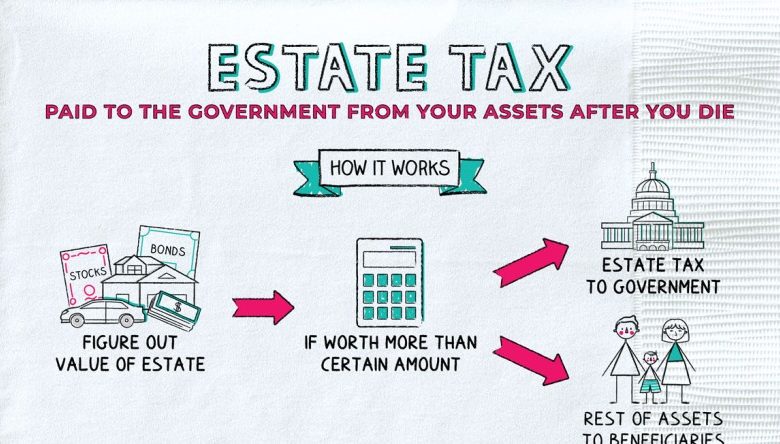

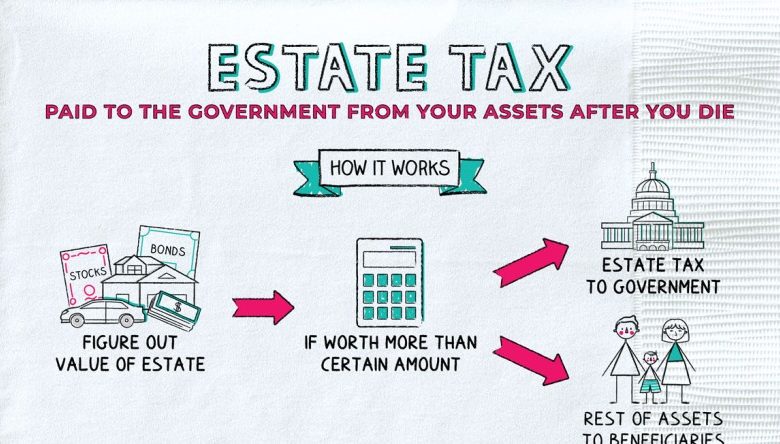

What is Estate Tax?

An estate tax is a tax that is levied on the value of the property that an individual owns at the time of their death. The amount of tax that is owed depends on the value of the estate, as well as the state in which the individual resides.

An estate tax is calculated by taking the value of all property owned by the individual at the time of their death and subtracting any debts or liens that are against the property. The remaining amount is then taxed at a rate that is determined by the state in which the individual resided.

Who Pays Estate Tax?

The estate tax is paid by the executor of the estate. This is the person who is responsible for managing the estate and distributing the assets to the beneficiaries. This means that the beneficiaries of the estate will not have to pay any taxes on the property that they inherit.

What are the Exemptions for Estate Tax?

Each state has different exemptions for estate tax, so it is important to check with your state’s tax laws to see what applies. However, some common exemptions include:

- Spouses. The spouses of the deceased are typically exempt from paying estate tax.

- Children. The children of the deceased are exempted from paying estate tax in most cases because they are considered to be the natural heirs of the estate.

- Charity. Gifts that are made to charity are typically exempt from estate tax because they are not considered to be part of the estate.

What Happens if You Don’t Pay Estate Tax?

If you do not pay the estate tax, the executor of the estate will be responsible for paying it. The executor may also be responsible for paying any interest and penalties that are associated with the unpaid tax. In some cases, the executor may be held liable for the entire amount of the tax if it is not paid.

What Property is Subject to Estate Tax?

All property owned by the individual at the time of their death is subject to estate tax. This includes real estate, personal property, stocks, bonds, and any other assets that are owned by the individual.

How Can I Reduce My Estate Tax Liability?

There are a few ways to reduce your estate tax liability. One way is to give gifts to your family members while you are alive. This can be done through trust or by making direct gifts. Another way to reduce your estate tax liability is to invest in property that is exempt from the tax. This includes life insurance policies and annuities.

When is Estate Tax Due?

The estate tax is due nine months after the date of death. However, if the executor files for an extension, the tax can be paid up to eighteen months after the date of death.

What is the Estate Tax Rate?

The estate tax rate is 40%. This means that for every $1,000 of value in the estate, the tax owed will be $400.

Who Should I Contact if I Have Questions about Estate Tax?

If you have questions about estate tax, you should contact your state’s tax office. You should also contact your estate lawyer in Fort Worth or wherever you are located. You can also consult with a tax advisor or accountant to get more information about how the tax applies to your situation.