Whether you have a small or big business, reconciling your account regularly has its own benefits. It is an important feature of QuickBooks that allows you to resolve anomalies between the bank and QuickBooks record. Reconciling is critical to ensure the accuracy of your financial records. It makes sure that the transactions in your QuickBooks match with that of your bank record. Using the Reconcile feature eliminates the need for investing in manual efforts. Reconcile in QuickBooks your bank account, or credit card at surprising speed. It is advisable to reconcile your savings or credit card account every month for keeping your records up-to-date.

To begin reconciling your account, check out the guide below.

Steps to Reconcile Your Accounts in QuickBooks

Before starting the reconciliation process, ensure that you have a credit card/ bank statement ready for the account you wish to reconcile. This will be required throughout the entire reconciliation steps.

Step 1. Visit to Reconciliation Page

There are two methods for performing reconciliation. The first one involves opening the Accounting tab present on the left side of the screen. Once you open it, a popup menu will appear, from its select Reconcile.

The second method involves selecting an icon that appears like gear placed on the left side of your company name. The icon looks identical to the settings icon in various other applications. Once the gear menu is open, select the Tools option. Once the menu opens, click on Reconcile and now the process is ready to begin.

Step 2. Select Account for Reconciliation

To begin, select the account you want to reconcile. Under the Accounts section, a drop down menu will appear from this you can select the account to reconcile. However, during this process, you will be required to fill in some details, including:

- Firstly, review Beginning Balance, it will usually display balance from last month’s statement. Make sure the Beginning Balance represented in your QuickBooks matches with that in your statements.

- The next field is Ending Balance; here you are required to fill the balance as on your current bank statement.

- Next is End Date, enter the end date on your bank statement also.

- Select Start Reconciling to move to the next step.

Step 3. Fill in Your Statement

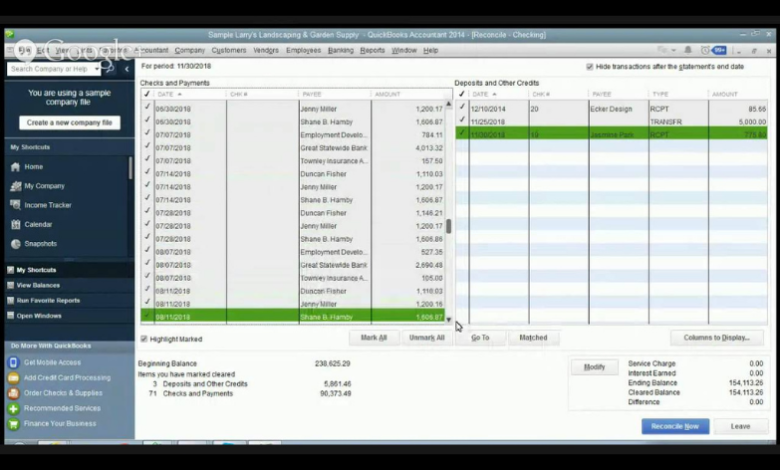

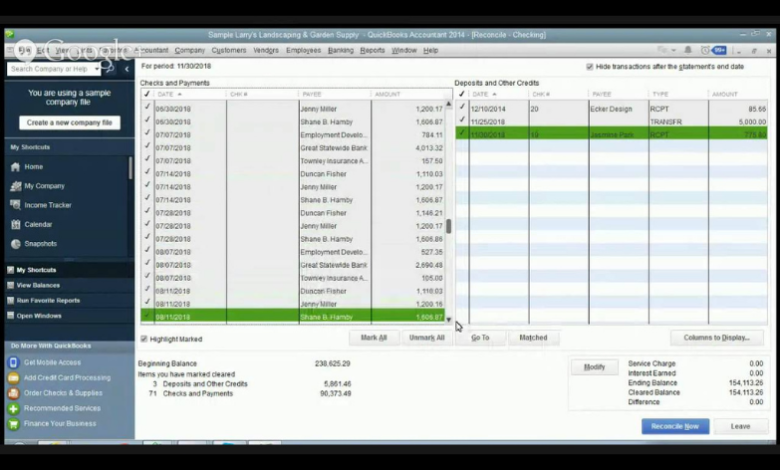

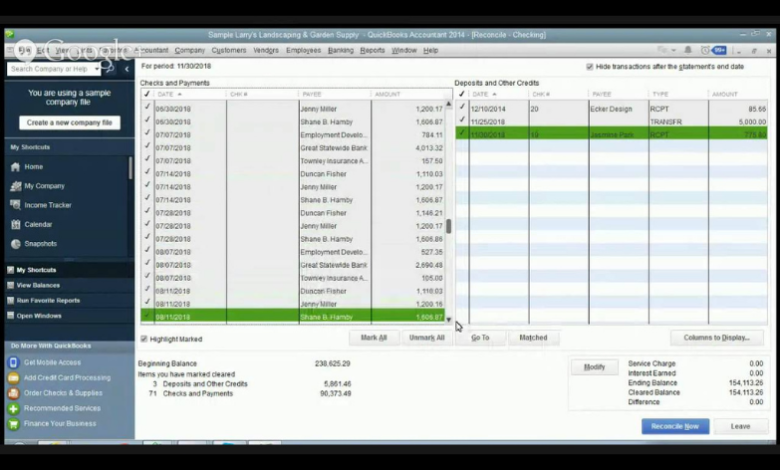

After starting reconciliation, you will be redirected to another screen where you will be required to fill in some necessary detail.

- Statement Ending Balance as same as mentioned in your account statement.

- Beginning Balance which will be the same as the ending balance from the previous month. However, this field will automatically get filled by QuickBooks.

- Cleared Balance- this will keep on changing with the reconciliation of your account. Payments- this will increase with the reconciliation of your account.

- Deposits.

- The difference– this will be calculated by QuickBooks.

- Transactions.

Once you are done with the above process and all your transactions match your bank statement, click on Finish Now to confirm reconciling. The system will present you with a reconciliation report after this. Remember to review and click on Save after the completion of the reconciliation process.

Every time you reconcile an account, a reconciliation report is generated. You can save this report in PDF format and even get it printed for checking further discrepancies encountered during the process.

In case if you have entered any wrong information as part of reconciliation, follow the steps mentioned below for correction:

- Click on the Modify option.

- Begin Reconciliation dialog box will appear.

- Update amount or any information entered wrong.

- Next, click Continue to return to the Reconciliation window.

Takeaway

It is good to get your account reconciled every month. This will help you maintain your account up-to-date. And the best practice is to reconcile your account soon after you receive your bank statement. Reconciliation is an essential process to keep your books accurate. Moreover, it is a straightforward, step-by-step process that is easy to perform. Over it, following this guide will make the process much easier for you. Hence, it can be interpreted that using QuickBooks is very easy and simplified. The application has an intuitive interface that comes with easy navigation. Even with little or no accounting knowledge, you can perform each task in the application.