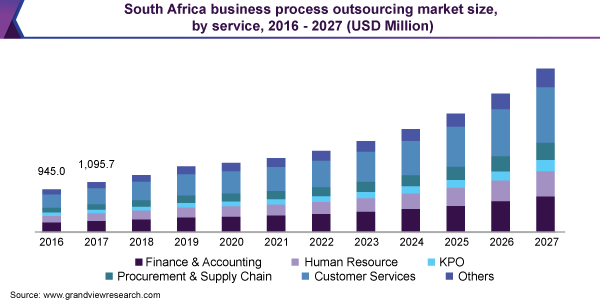

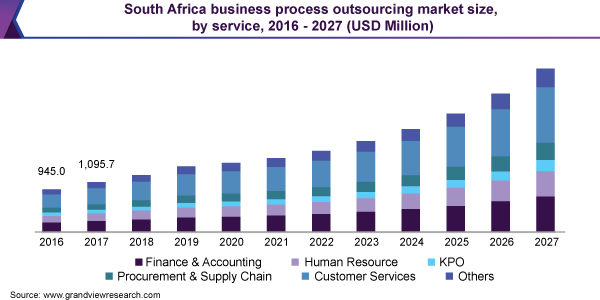

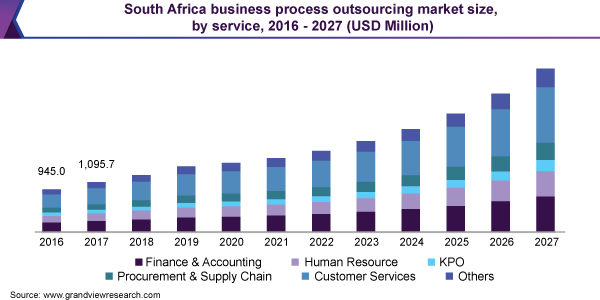

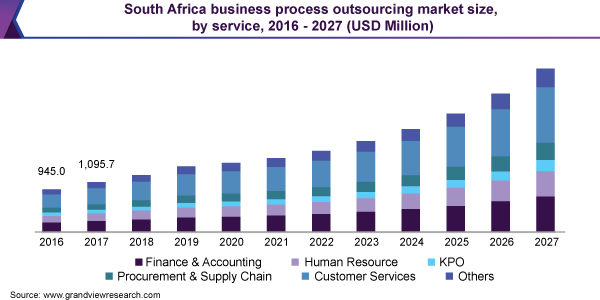

South Africa Business Process Outsourcing Market Size, Share & Trends Analysis Report for the Service (Customer Services, Finance & Accounting) And By End-Use (BFSI, IT & Telecommunications) and Segment Forecasts, 2020 – 2027

There is a South Africa business process outsourcing market size was USD 1.4 billion in 2019 and is expected to grow at a compound annual growth amount (CAGR) of 13.2 percent between 2020 and 2027. This market’s growth is characterized by advancements in technology, continued innovation, and intensifying competitiveness, which is expected to persist over the next few years. Controlling operating costs, integrate processes, focus on core competencies, and hire qualified professionals is expected to drive the market over the coming years. South Africa has been home to numerous call center operations for many years, and thus has gained global acceptance as a favored and reliable offshore outsourcing destination.

It also ranks as one of the leading locations with respect to Global Business Services – or offshoring business processes. Adequate expertise, a large capacity of employees, lower costs and easy-to-understand English accents are just a few of the primary reasons prompting companies to consider South Africa among their preferred outsourcing destinations. With a particular focus on analytical and Artificial Intelligence (AI)-driven solutions, South Africa has a larger quantity of actuarial professionals as in comparison to India and has the ability to offer support for a wide range of languages including French in addition to Spanish. The use to use artificial intelligence and robotics as a complementary strategy for human resources management can aid the companies in South Africa BPO industry. South Africa BPO industry in the race against competitors in Europe and the Middle East & Africa.

This is likely to boost development of the market in the coming future. In addition, Business Process Enabling South Africa, the Best African BPO company industry body has played a major part in encouraging the industry’s growth by helping to develop skills, sharing best practices, and providing its members with connections to business networking networks & associations that influence the sector’s transition into technology-driven economies. In addition to that, The South African government has introduced various tax incentives and programs for the development of infrastructure and support for the development of skills. One of the most prominent programs can be described as the Monyetla Work Readiness Program.

The focus of this program is to expand the pool of able to work entry-level employees. The program is based on it’s Monyetla Work Readiness Program, BPO employers lead a group approach to recruit and train entry-level staff. These initiatives create youth employment opportunities and contribute to the region’s earnings from offshoring services. It is evident that the BPO sector in SA continues to grow and is bringing new opportunities for employment which, in turn, play a key part in the region’s economic growth. Outsourcing service providers think the fact that South Africa enjoys better opportunities as compared to other countries in Africa in the provision of the business services that outsourcing companies require. Cape Town has particularly emerged as an ideal BPO destination of choice.

Service Insights

The service sector for customers dominated the market with a market share of over 31% in 2019 and will expand further at the fastest CAGR between 220-2027. This rise is due to the rising number of service centers which require online and offline technical support. Customer service BPOs specialize in handling questions from customers via telephones, chat, emails, social media platforms, as well as other channels. Customers can contact them via chat, email, social media platforms and other channels. BPO sector is growing throughout Cape Town and has risen significantly over the last few years. The industry is expected to experience significant growth over the coming years. Additionally, South Africa holds an advantage when it comes to services for customers BPO services. The capacity to assist businesses reduce their overall expenses coupled with the rapid shift to remote work due to the Covid-19 pandemic has earned the customer services centers of South Africa an edge over other hubs.

The segment of finance and accounting will grow at a rate of 13.6% during the forecast time. The benefits of finance and accounting BPO services in cost reduction of finance functions is also driving their widespread adoption across numerous financial institutions throughout the country. South Africa is steadily advancing in the area of international services to the financial services industry. Numerous financial institutions are increasingly settling on South Africa for establishing their African back-office shared services hubs to be part of their global delivery networks.

End-of-use Insights

The IT & telecommunication segment was the dominant market in the region with a share of greater than 35% in 2019. The telecommunication and IT sectors is among the biggest adopters of BPO services. In the IT space, South Africa has performed a vital role in the realm of technical helpdesk and service desk because of its excellent vocal skills. Additionally, the country is comprised of a substantial number of IT graduates who have the appropriate technical abilities, which can reduce the obligation and the cost of training for companies. South Africa continues to remain one of the top locations to outsource IT services due to the growing number of firms. These firms provide IT-focused solutions to a variety of industries that include web design and development, and development of applications and platforms. The rising ICT expenditure in the country , for regular maintenance of existing IT and communication systems and for the replacement of systems that are no longer in use will drive sector’s growth.

It is expected that the BFSI segment is predicted to achieve the highest CAGR throughout the forecast period. The accessibility of a qualified workforce, comprising Chartered Financial Analysts (CFAs), Chartered Accountants (CAs) and actuaries, have been the driving force behind success for South Africa in this area. Moreover, global banks are increasingly choosing South Africa for the delivery of intricate banking and finance, including life process for fund accounting and insurance. The country offers a vast array of voice communications for insurance such as commission handling, the processing of claims, and also policy administration.

Key Companies and Research on Share of Market

The market is highly competitive as most of the large companies are focusing on increasing their market share by implementing various business strategies such as partnership, mergers & acquisitions and product development. These strategies allow companies to expand their reach geographically, and increase their offerings across the international and national markets. For example, in August 2020, WNS (Holdings) Ltd introduced EXPIRIUS an innovative customers’ experience (CX) solution that integrates human-assisted designs with AI-driven chat information to enhance customer experiences. The major players within the South Africa business process outsourcing market include:

- Accenture Plc

- Amdocs

- Capgemini

- HCL Technologies Ltd.

- IBM Corp.

- Infosys Ltd. (Infosys BPM)

- NCR Corp.

- Sodexo

- TTEC Holdings, Inc.

- Wipro Ltd.

- Mango5 BPO

- Indox (PTY) Ltd.

- Outworx Contact Centre

- SA Commercial

- Talksure Group

- Boomerang Marketing

- iContactbpo

- 121 BPO Services

- Altron

- The IT Guys

- Merchants SA (Pty) Ltd.

- CCI South Africa

- Capita plc

- Digicall Group

- DSG Group

- Startek

- WNS (Holdings) Ltd.

- Webhelp

- O’Keeffe & Swartz

- Ignition Group

- Rewardsco

- Teleperformance SE

- Encore Capital Group

- Pra Group, Inc.

- Paschoalotto Logo

- Pioneer Credit

- Credit Corp Group

- Collection House Ltd.

Segments Covered by the Report

The report predicts growth in revenue at the national level and provides an analysis on the most recent industry trends from 2016 to 2027 across every sub-segment. To make this research, Grand View Research has subdivided its South Africa business process outsourcing market report based on use and service:

- Service Outlook (Revenue USD Million (2016 – 2027)

- Finance & Accounting

- Human Resources

- Knowledge Process Outsourcing (KPO)

- Supply Chain & Procurement

- Customer Services

- Other

- “End-use” Outlook (Revenue, USD Million (2016 – 2027)

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Manufacturing

- IT & Telecommunication

- Retail

- Other